Barbara Corbellini Duarte/ Business Insider

Welcome to Insider Cannabis, our weekly newsletter where we're bringing you an inside look at the deals, trends, and personalities driving the multibillion-dollar global cannabis boom.

Sign up here to get it in your inbox every week.

The biggest US cannabis companies – including Trulieve, Green Thumb Industries, and Curaleaf – reported strong earnings this week. But their stock prices still fell, for the most part.

Why's that?

"I think, quite frankly, nothing's new when it comes to US cannabis," Trulieve CEO Kim Rivers told me in an interview yesterday. "A good portion of that comes from the way our stocks are required to be listed."

US cannabis company can't list on US exchanges because cannabis is federally illegal. Rivers says that without exposure to deeper-pocketed institutional investors on the NYSE or Nasdaq, the story will continue to be the same.

It also didn't help that Wasatch, a Salt Lake City-based asset manager, was reportedly forced to unwind its positions in US cannabis names because of issues with compliance and finding a custodian.

"I think there's certainly going to be a change in that dynamic once uplisting is allowed," Rivers said. Trulieve, like Green Thumb Industries, has already filed with the SEC to prep for an uplisting. The ball is now in Congress's hands to provide clarity as to how they'll treat cannabis. Senate Majority Leader Chuck Schumer said this week that a comprehensive reform bill should land before the end of the month.

The silver lining to all this uncertainty, however, is the opportunity that cannabis executives say will benefit early investors.

"There's a generational opportunity for folks to make an investment now and solidify their position because we certainly think larger institutional capital will be coming in as soon as they're able to do so," Rivers said.

Let's get to it.

- Jeremy Berke (@jfberke) & Yeji (@jesse_yeji)

If you like what you read, share this newsletter with your colleagues, friends, boss, spouse, strangers on the internet, or whomever else would like a weekly dose of cannabis news.

Here's what we wrote about this week:

Trulieve is paying $2.1 billion in a blockbuster bid to dominate Arizona's cannabis market, while the rest of the industry is focused on New York

Trulieve is buying Harvest Health & Recreation in an all-stock deal that values the target at $2.1 billion. The deal will make Trulieve the largest cannabis retailer in Florida and Arizona.

The combined company will be the largest US cannabis company by footprint and revenue.

Top investors say Trulieve's blockbuster Harvest deal will push its cannabis rivals to pursue big-ticket M&A

Cannabis investors say Trulieve's deal with Harvest will put pressure on rival companies to pursue big-ticket M&A. These companies include Curaleaf, Green Thumb Industries, and Cresco Labs.

Legendary dealmaker Irwin Simon reveals the toughest part of closing Tilray's $4 billion cannabis mega-merger

Tilray and Aphria closed a $4 billion mega-merger last week. The vote was delayed because the companies struggled to get retail shareholders to show up and vote.

Tilray's CEO Irwin Simon said it's a new challenge for M&A in cannabis and other industries.

The 12 cannabis companies that are most likely to be acquired as a fresh wave of M&A sweeps the industry

As M&A is expected to ramp up in the cannabis sector, Viridian analyst Jonathan DeCourcey named in a Thursday note 12 smaller to medium-sized companies likely to be acquired. Acquisition targets include Vireo Health, Lowell Farms, and TILT, among others.

VIDEO: Two veteran investors on how to bet on the spread of US marijuana legalization

If you missed our panel on how to bet on cannabis legalization in the US, watch the full recap.

Executive Moves

- TILT Holdings president Gary Santo is taking over from Mark Scatterday as CEO, the company said on Friday. Scatterday will continue as chairman.

- Scott Schilling, the former CMO of Prestige Beverage Group, is now CEO at LeafLine Industries, a Minnesota CBD and medical cannabis company.

- Harborside said on Tuesday that hemp executive Travis Higginbotham Jr. will join the company as vice president of production.

- GrowGeneration said on Tuesday that Dennis Sheldon has been appointed as senior vice president of global supply chain.

Deals, launches, and IPOs

- Trulieve is buying Harvest Health & Recreation in a $2.1 billion deal. Read our story here.

- Cannabis company Holistic Industries raised $55 million through a convertible note, led by the Harbert Stoneview Fund.

- Green Thumb Industries will buy Virginia cannabis company Dharma Pharmaceuticals for $80 million.

- Colombian cannabis producer Flora Growth Corp. went public on the Nasdaq on Wednesday, raising nearly $17 million. CEO Luis Merchan said in an interview he hopes to be able to import cheaper, high-quality cannabis into the US - Flora can grow cannabis at 6 cents per gram, versus the average cost of over $1.25 per gram for North American growers.

- Cannabis company Auxly announced on Thursday that it had raised $8 million in a private placement.

- Cannabis supply chain platform Lucid Green announced on Tuesday that it had raised $3.1 million in funding from Silverleaf Ventures, HALLEY Venture Partners, and other investors.

- The Boston Beer Company - the maker of Sam Adams - established a subsidiary in Canada to research the development of non-alcoholic cannabis beers. The subsidiary will be led by Paul Weaver.

- Psychedelics company Wesana said on Wednesday that the company would be entering a multi-year research partnership with the World Boxing Council to study the effects of psilocybin on traumatic brain injury (TBI).

- Cannabis media company Civilized is relaunching. Terri Riedle will be the new CEO. Read our deep dive into Civilized's downfall from last summer.

- The ETF Managers Group is launching MJUS on the NYSE, an ETF that will track US cannabis stocks.

Research and data

- A new study published in the journal Psychopharmacology found that cannabis improves quality of life for patients with conditions such as chronic pain, MS, PTSD, epilepsy, Tourette's, and more.

- The National Institute on Drug Abuse (NIDA) announced that a standard THC unit will be 5 milligrams, Cannabis Wire reports.

Policy moves

- Republican lawmakers Rep. David Joyce and Rep. Don Young filed The Common Sense Cannabis Reform for Veterans, Small Businesses, and Medical Professionals Act on Wednesday - a bill that would federally legalize cannabis, per Marijuana Moment.

- The Minnesota House on Thursday voted to legalize marijuana for adults by a margin of 72-61. The bill faces long odds in the state's Senate, The Star Tribune reports.

AP Photo/Steven Senne, File

Earnings roundup

Busy earnings week. Here are the highlights:

- Harvest Health & Recreation released its Q1 results on Monday, reporting $88.8 million in net revenue and a $23.1 million net loss.

- Village Farms released its Q1 results on Monday, reporting $52.4 million in net revenue and a $7.4 million loss.

- Curaleaf released its Q1 results on Monday, reporting $260 million in net revenue and a $17.2 million loss.

- Acreage released its Q1 results on Tuesday, reporting $38.4 million consolidated revenue and a $7.8 million net loss.

- MedMen released its fiscal Q3 results on Tuesday, reporting $32 million in revenue and a $13.7 million loss.

- Green Thumb Industries released its Q1 results on Tuesday, reporting $194.4 million in net revenue and a $10.4 million profit.

- Trulieve released its Q1 results on Thursday, reporting $193.8 million in net revenue and a $30.1 million profit.

- GrowGeneration released its Q1 results on Thursday, reporting $90 million in net revenue and a $6.1 million net profit.

- Aurora released its fiscal Q3 results on Thursday, reporting C$55.2 million in net revenue and C$24 million in adjusted EBITDA loss.

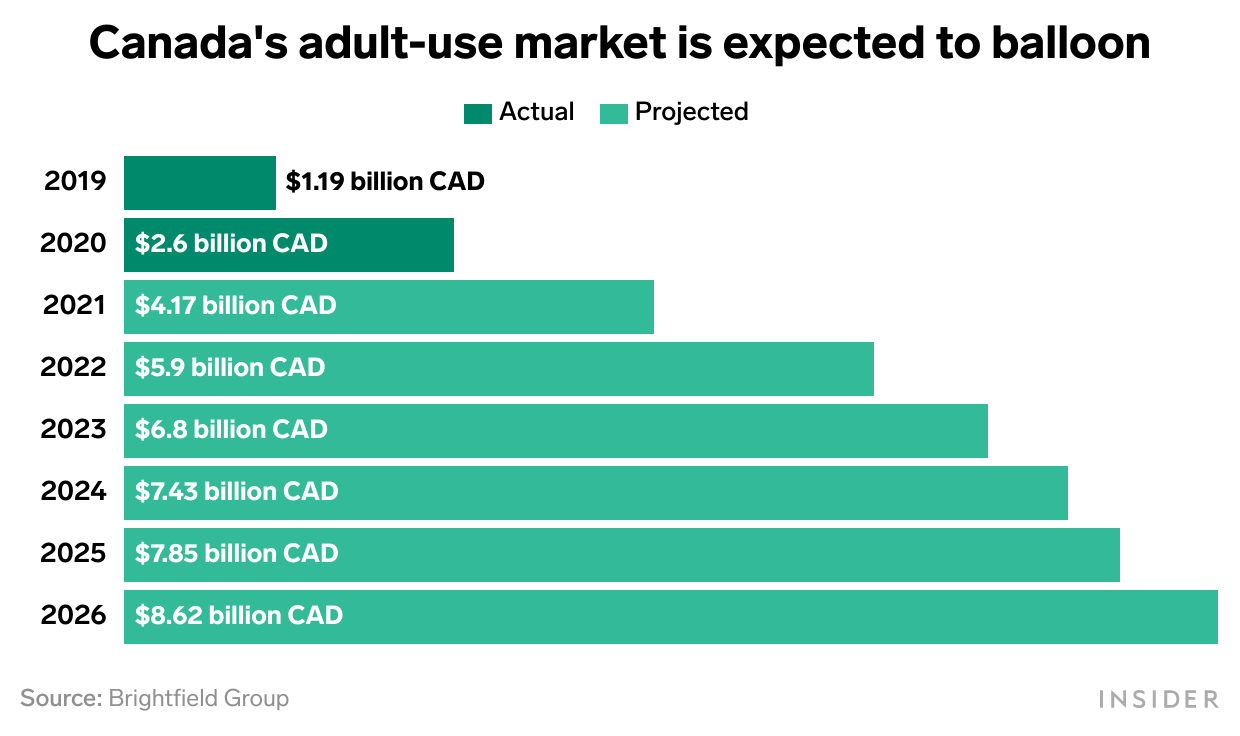

Chart of the week

Canada's recreational cannabis market is set to reach more than C$8 billion by 2026, according to Brightfield Group, which says that much of this growth will be driven by more retail openings, M&A activity, and the accessibility of affordable cannabis:

What we're reading

The Psychedelic Revolution Is Coming. Psychiatry May Never Be the Same. (New York Times)

America's most conservative states are embracing medical pot (Politico)

Hard Times for High Times (The Fresh Toast)

After Building Cannabis Stake, a Mutual Fund Sells for Compliance Reasons (Barrons)

One of the pot industry's best highs is fading (Wall Street Journal)

'If you build it, they will come': California desert cashes in on early cannabis investment (NBC News)

Banks are still afraid of cannabis. Here's why. (Boston Business Journal)